Shortly after bidding farewell to 2023, it’s time to look back from the perspective of the automotive industry. From shifting consumer preferences to advancements in technology and global supply chain disruptions, the sector has experienced several changes.

This article delves into the notable events that unfolded in the global automotive industry in 2023, with a particular focus on the UAE. Additionally, we’ll explore the key trends and predictions shaping the automotive industry’s trajectory in 2024.

The Global Automotive Landscape in 2023

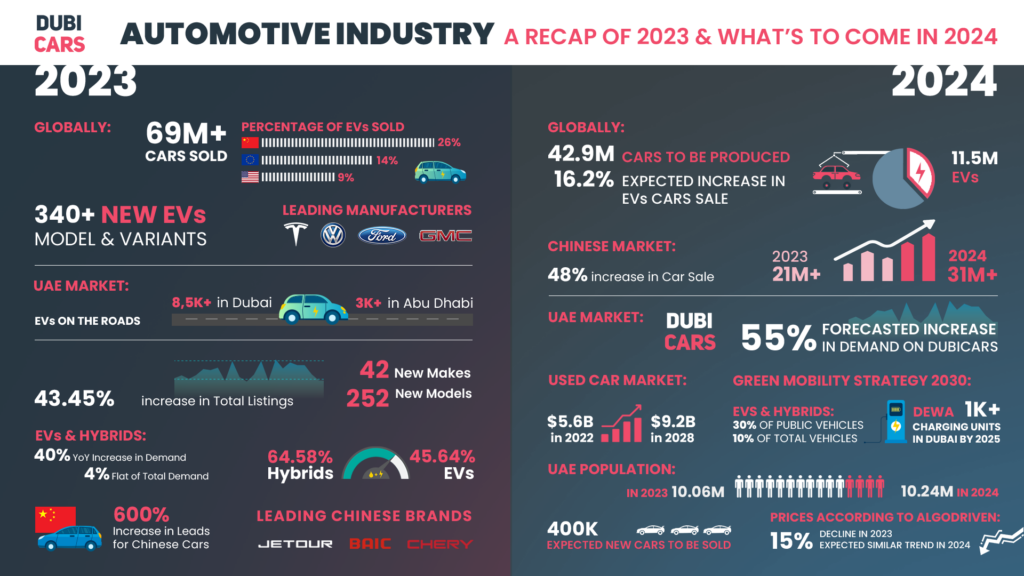

2023 was a pivotal year for the global automotive industry, marked by a series of transformative events. 2023 -2029 is a period during which the automotive industry is expected to grow rapidly. In 2023, global car sales crossed 69 million units and this is just the beginning.

One of the defining factors was the accelerated adoption of electric vehicles (EVs) which also had an effect on the UAE’s car market. Driven by environmental concerns and the need to reduce carbon emissions, governments introduced policies and incentives to promote electric mobility.

In 2023, electric vehicles made up 14% of all vehicles sold in the European market. In the United States of America, EVs made up 9% of all car sales while in China, electric vehicles made up 26% of all cars sold.

Major automakers responded by unveiling a slew of electric models, each promising cutting-edge technology and sustainable driving experiences. Over 340 new electric vehicle models and variants were launched in 2023 across several markets.

The transition to electric vehicles gained momentum in major automotive markets like Europe, the United States, and China. Traditional automakers and new entrants alike engaged in fierce competition to capture market share. This allowed them to establish themselves as leaders in the burgeoning electric vehicle segment.

Tesla continued its dominance, but legacy manufacturers such as Volkswagen, Ford, and General Motors made strides in narrowing the gap. In parallel, the concept of mobility-as-a-service (MaaS) gained prominence, reshaping how people viewed and interacted with transportation and challenging traditional ownership models.

Ride-hailing services, autonomous vehicles, and the integration of smart city infrastructure are some examples of MaaS. It became a 31.1 billion dollar industry in 2023 and it is expected to grow to 144 billion dollars by 2028.

The UAE’s Automotive Industry In 2023

Long known for its affinity for luxury cars and high-performance vehicles, the region began witnessing a gradual shift towards more sustainable mobility in 2023. The Global shift towards EVs is something that had a cascading effect on the UAE as well. More EVs are currently on sale than ever before.

According to automotive industry statistics, more than 8,500 electric vehicles were plying on Dubai’s roads in 2023. There were more than 3,000 electric vehicles in Abu Dhabi. In response to global trends, UAE brands, agencies, and even the government began investing heavily in EV infrastructure and incentivized the adoption of electric vehicles.

DubiCars’ EV and Hybrids listings saw an impressive increase too. The number of EVs listed for sale on DubiCars increased by 45.64% and hybrids increased by 64.58% in 2023 when compared to 2022.

Dubai’s RTA recently announced its strategic plan for 2024-2030 which includes a smart transportation solution featuring electric vehicles. Car manufacturers embraced this change, introducing electric and hybrid models tailored to the preferences of customers in the region.

The demand for opulent yet eco-friendly vehicles soared, showcasing a unique blend of luxury and sustainability in the region’s automotive landscape. Immense interest in the recently teased Range Rover Electric SUV is a perfect example of the same.

New Car Launches & Reveals

It is always a great sign for any industry when new products are launched every now and then. It just goes to show that there are more buyers in the market. The Automotive industry in 2023 saw an influx of new cars. Be it just a reveal or a full-scale launch, the automotive industry saw several new cars in 2023.

At DubiCars, 42 new car manufacturers and 252 new models were added to the database in 2023, which is proof of more cars being available for purchase in the UAE. Here’s a list of some of the noteworthy new cars from 2023. Click the link to learn more details about these cars.

- Audi Q8 e-Tron

- Great Wall Motor Tank 300 & Tank 500

- Ineos Grenadier Quartermaster

- GAC Emzoom R-Style

- Exeed RX

- 2024 Tesla Model 3

- 2024 Alfa Romeo Tonale, Stelvio & Giulia

- MG T60 Pickup Truck

- 2024 Porsche Cayenne

- 2024 Maserati GranTurismo

- Geely Tugella

- 2024 Porsche Panamera

- Toyota Land Cruiser 70

- Toyota Land Cruiser 250

Increase In Car Stock

With the arrival of more car models in 2023 came a significant increase in stock. Dealers across the UAE stocked up on more cars and the number increased significantly. DubiCars recorded a significant milestone of 29,728 cars being listed.

That is an impressive 43.45% increase in the number of listings compared to the highest number from 2022. Check out new cars for sale in the UAE and used cars for sale in the UAE.

Diminishing Automotive Industry Supply Chain Challenges

2023 also saw the weakening of the challenges faced by the global supply chain. The semiconductor shortage that the automotive industry faced since the onset of the pandemic was overcome and production got back on track to an extent.

Chinese Cars

The automotive industry saw the rise of Chinese car manufacturers like never before. Long gone are the days when Chinese cars were cheap both in price and quality. Chinese cars are now high-quality products loaded with features and great performance. One quick look at our Exeed RX review should give you an idea of just how good Chinese cars are these days.

China produced around 8.5 million electric vehicles in 2023, and thousands of these landed in the car markets of the UAE. In the UAE, Chinese car manufacturers are being more widely accepted. Their proposition of offering top-notch features at an affordable price is simply unmatched by their Japanese, European, and American counterparts.

DubiCars’s data further substantiates the growth of Chinese cars. In 2023, Chinese cars received 2.68% of the total number of leads on DubiCars, compared to 0.53% in 2022. On the whole, Chinese cars received a whopping 600% more leads in 2023 when compared to 2022.

Taking a look at a few well-known Chinese brands, Chery listings received 392% more leads while BAIC listings received a massive 810% more leads and leads on Jetour listings increased by 2,376%! Here’s a list of the Top 10 Chinese Cars In The UAE and Top 10 Chinese Car Manufacturers In The UAE.

2024 Automotive Industry Outlook: A Glimpse into the Future

As the automotive industry gears up for 2024, several trends and developments are poised to shape its trajectory. In the UAE, the used car market size was worth $5.6 billion in 2022 and is well on the trajectory to touch a massive $9.2 billion by 2028. 2024 will be a key period for the automotive industry to demonstrate impressive growth.

Craig Stevens, CEO of DubiCars said, “The UAE used car market continues to be dynamic and ever-changing. New supply, new vehicles, new technologies, and an increasing population have driven massive change. To be successful going forward, there will need to be a major focus on delighting the customer and making decisions based on data and insights.”

Here’s what to expect from the Automotive industry in 2024 both in the UAE and on a global scale:

Continued Economic Stability In The UAE

One of the factors that positively affect the used car market in the UAE is the country’s economic prowess. It is always in a state of growth and expansion, and hence, buyers in the country feel confident investing in expensive goods such as cars. This strong economic growth and the resulting confidence in purchasing cars is expected to continue through 2024.

More Chinese Cars

Starting off 2024 on the same note that we left 2023 on! The influx of Chinese cars is set to continue and along with more Chinese cars coming in, the number of people buying Chinese cars is going to increase.

In 2023, China produced over 29 million cars and Chinese domestic sales stood at 21 million units. Moving on to 2024, automotive industry reports have revealed that the total number of car sales in China will surpass 31 million units, a 48% increase.

While production estimates aren’t currently available, we can predict that with the same 48% increase, China will end up producing a massive 42.9 million cars in 2024.

Continuation Of The Electric Vehicle Revolution

The momentum behind electric vehicles is expected to persist, with more car manufacturers introducing new models and governments implementing policies to phase out internal combustion engines.

In 2023, the electric vehicle segment grew by 16% globally and this will only increase in 2024. The UAE too will continue to embrace this shift, promoting sustainable transportation solutions and fostering a conducive environment for EV adoption. If you’re one among the thousands looking for an EV, here’s a list of the Top 10 Electric Cars To Buy In The UAE.

Though the market has been growing in size, demand for electric vehicles has been rock-steady at 4% for the past three years. However, this is expected to grow further in 2024. Know more about the search patterns and trends for EVs & Hybrids in the UAE. The number of EVs produced in China is expected to surpass initial estimates of 11.5 million units. Which is a tentative increase of around 36%.

Hundreds of these EVs are expected to land in the UAE’s car markets. Add to this, the massive increase in the number of EVs produced by legacy car manufacturers, and you get an idea of where this is going.

Electric Vehicle Infrastructure

According to Dubai’s Green Mobility Strategy 2030, 30% of public sector vehicles and 10% of all vehicle sales must be either an EV or a strong hybrid by 2030. We certainly are heading in that direction. The total number of electric vehicles on UAE’s roads is expected to exceed 15,000 units by a large margin in 2024.

The Dubai Electricity & Water Authority (DEWA) has set a target of installing more than 1,000 chargers across the emirate of Dubai by 2025. In order to achieve this target, DEWA is expected to ramp up EV infrastructure in 2024.

Advancements in Autonomous Driving

The pursuit of autonomous driving technology will intensify, with collaborations between traditional automakers and technology companies reaching new heights. While fully autonomous vehicles may still be somewhere on the horizon, incremental advancements in driver-assistance systems and connected vehicles will be prevalent.

The global ADAS market size was valued at around $112,949 million in 2023 and it is expected to touch $324,870 million by 2030. If you’re interested in autonomous vehicles and advanced driver assistance systems, our guide to ADAS and its terminologies is something you would want to check out. ADAS will soon be standard practice across all models sold by car manufacturers in most markets.

Resilience In Automotive Industry Supply Chains

The lessons learned from the supply chain disruptions resulting from the pandemic will continue to drive a renewed focus on resilience. Both global and regional automotive markets will prioritize building resilient supply chains, incorporating digital technologies, and fostering local manufacturing capabilities to mitigate future disruptions.

Reports have revealed that a 19% reduction in dependence on off-shore suppliers is expected by 2025. This leads to more localised supply chains which are more resilient to disruptions.

Shift In Consumer Preferences

Consumer preferences will continue to evolve, influenced by factors such as sustainability, connectivity, and affordability. Using tools like Google Trends, we find that the EV and Hybrid market is relatively flat YoY, however, on DubiCars we have seen demand for EVs and Hybrids increase by over 40% YoY. Yet, it is still at just 4% of the total demand.

We are expecting to see this segment grow significantly over this year as new models with lower price points enter the market. The automotive industry will need to adapt swiftly to these changing dynamics, offering diverse options that cater to the varying needs of a modern car buyer. In 2024, 16.2% of all new car sales across the globe are expected to come from electric vehicles.

Expected Decrease In Demand

Automotive Industry experts and trends have indicated the demand for cars is set to become a little softer. While this might soften the market a bit in the first few months, the automotive industry is expected to pick up pace in the latter part of the year.

The expected decrease in demand might hold true for the Global market. However, in the UAE we expect the opposite due to an increase in population. The population of the UAE stood at 10.06 million in 2023 and this is expected to rise to 10.24 million in 2024.

The government of Dubai even launched the Dubai Urban Master Plan 2040 to cater to the explosion of population. It is expected that a majority of these new residents will end up buying cars, thereby resulting in an increase in demand in the auto sector.

Prices Will Drop

Prices of cars are set to drop in the first few months. This will be an indirect effect of the decrease in demand. However, the price drop is expected to revive sales to an extent. Data from our Valuation Partner AlgoDriven reveals that used car prices saw a steady decline in 2023 and the same is expected to continue at a stable pace in 2024 too.

Glenn Harwood, Co-Founder of AlgoDriven said, “With an average 15% drop in used car prices in 2023 and a similar forecast projected for 2024, we are seeing the market return to how it performed PreCovid. While some models remain in high demand, generally, more supply has entered the market and that’s why prices are starting to fall. Dealers need to recognise that this is now the market trend and therefore a focus on pricing and fast stock turn is key to running a successful used car operation”

In terms of percentages, the UAE car market saw an approximate cumulative decline of around 15% in 2023 while the highest month-on-month decline stood at around 1.75% in July 2023. The decline in 2024, however, will be more stable and prices aren’t expected to fall to pre-covid levels.

More Volume In The Automotive Industry

2024’s expected decrease in demand globally is relative to the demand experienced by manufacturers and dealers in 2023. Despite the slight decrease in demand, the overall volume of the car market will go up.

This simply means, more cars will be produced and more cars will turn up at dealers, hence there will be more stock for buyers to choose from. AlgoDriven Reveals that new car inventory levels are on the rise and there are certain models with excess stock. Reports estimate an increase of 4% in car production volume globally.

The UAE remains a key export market and continues to supply several countries with a choice of cars that are otherwise unavailable in those markets. The perfect example of the same is the fact that, Demand for car exports from the UAE to Russia increased by over 200% since the start of the war.

Lower Used Car Inventory Levels

During the pandemic in 2020 and 2021, the number of new cars sold touched new lows. This is the biggest reason for a fewer number of used cars to come into the market in 2024. The number of used fleet cars coming into the market for sale is also expected to be low in 2024.

With more big players stepping into the used car business, there are more options for buyers to pick from. In addition, there are used car giants offering warranties and car return options, further proving their cars are of a higher quality. This competition will prove to be healthy for the used car market.

Normalised Depreciation Levels

Depreciation rates for cars returned to normal levels in 2023. According to AlgoDriven, a three-year-old Nissan Sunny depreciated by 12% in 2023, the value of a three-year-old Toyota Land Cruiser dropped by 8% while a three-year-old Mercedes-Benz G-Class depreciated by 18%.

These numbers are considered normal levels of depreciation for these cars and the same normalcy is expected to continue in 2024 as well.

Average Number Of Days For A Used Car Sale

In the used car marketplace, there are fast-selling cars like the Toyota Land Cruiser, Nissan Altima, Hyundai Tucson, etc. There is a constant demand for these cars and hence they sell quickly.

However, certain premium cars and supercars do not have such levels of demand. Cars like a Lamborghini Aventador or a Rolls-Royce Ghost will sell relatively slower. According to AlgoDriven Data, the average number required for a car to sell in the UAE currently stands at 50 days, just as it was at the beginning of 2023.

This number had dipped in the middle of the year coinciding with the reopening of schools. However, it has risen back to 50 days and the same cycle is expected to continue this year as well. Dealers can expect to sell used cars more quickly in August and September than in other months of the year.

More Brands Set To Enter The UAE

This one’s quite obvious and it applies more to the UAE car market than any other market in the world. More car manufacturers are looking at entering the UAE car market than ever before most of these new brands will be Chinese.

It includes the likes of Dongfeng, Nio, Ora, etc. Here’s a list of the Top Chinese Car Manufacturers Coming To The UAE in 2024. In addition, several start-ups are getting into the EV industry and are looking to be a part of the dynamic car market in the UAE.

More than 400,000 new cars are expected to be sold in the UAE in 2024. The government anticipates this sharp increase in the number of vehicles and the peak in traffic that comes with it. Hence, there are several new road projects in the pipeline. The recently announced Hessa Street improvement project is a perfect example.

More upcoming road projects include the Dubai-Al Ain road improvement project, the Sheikh Rashid bin Saeed corridor improvement project, the Umm Suqeim Street Project, and the Al Khaleej Street project.

Pricing Matters

Both buyers and sellers will have to pay a lot of attention to the pricing aspect as this will matter a lot. If you’re selling a car and the price you’re asking for is above the market price, it will lead buyers to walk away and find a better deal elsewhere. The same logic applies even when you’re a buyer. Pay the right price and nothing more.

We have seen on DubiCars that private sellers on average price their cars 36.02% higher than the market value and a whopping 47% higher than similar cars listed by a dealer. This percentage will be forced to drop in 2024 given that the upcoming automotive industry trends are leaning towards lower prices.

DubiCars’ data also reveals that sellers who have priced their listings higher than on a competitor’s platform have a 20% lower number of leads. Private sellers’ listings that are priced higher than a dealer on DubiCars receive 25% fewer leads on their ads. So, price your car listing well in 2024. Use the DubiCars’ car valuation tool to know the correct value of your car.

As we reflect on the challenges and triumphs of the automotive industry in 2023, the road ahead in 2024 holds immense promise and excitement. As we accelerate into 2024, the automotive industry is set to redefine itself, embracing innovation and sustainability on a global scale while catering to the unique dynamics of the UAE market.

Also Read:

– Car Shipping Becomes More Expensive: Red Sea Conflict

– Car Trims/Variants: Everything You Need To Know

The post Automotive Industry — A Recap Of 2023 & What’s To Come In 2024 appeared first on Dubi Cars - New and Used Cars.

from Dubi Cars – New and Used Cars https://ift.tt/xmkj3tu

https://ift.tt/euBiWGo